- Perfect Putt

- Posts

- Callaway's Distribution Moat

Callaway's Distribution Moat

Every Monday, I write a newsletter breaking down the business in golf. Welcome to the 430 new Perfect Putt members who have joined us since the last newsletter. Join 8,983 intelligent and curious golfers by subscribing below.

Read Time: 6 minutes.

Today’s newsletter is powered by TruGolf.

Meet TruGolf — a Global Leader in Golf Technology.

From Launch Monitors, Golf Simulators, and the industry-standard E6 CONNECT software, TruGolf develops innovative solutions to make it easy to Play, Improve, and Enjoy the game of golf.

This Is Virtual Golf.

• APOGEE – This camera-based Launch Monitor is the best tool on the market for golfers looking to improve their game. APOGEE does not require marked clubs or specialty balls.

• E6 APEX – Meet E6 APEX, the ultimate golf software solution. E6 APEX features real-time course data, in-depth shot analysis, and graphics you have to see to believe.

• The Future of Indoor Golf – E6 APEX and APOGEE have set the bar for realism. The jaw-dropping visuals and lag free gameplay are the new standard for virtual golf.

Meet the Next Generation of Virtual Golf at TruGolf.com

Hey Golfers —

A little over three months ago, Callaway’s stock price briefly traded below $10 a share. Their stock price was down nearly 50% on the year in November. It has since popped 48% from that point.

While the stock price has shown improvement and trended in the right direction — it is still down 39% from its 52-week high.

Callaway reported its annual financial results last week. I have several takeaways — let’s dive into it.

A friendly reminder that Callaway owns several brands. They break their revenue into three buckets.

Topgolf

Golf equipment

Active lifestyle

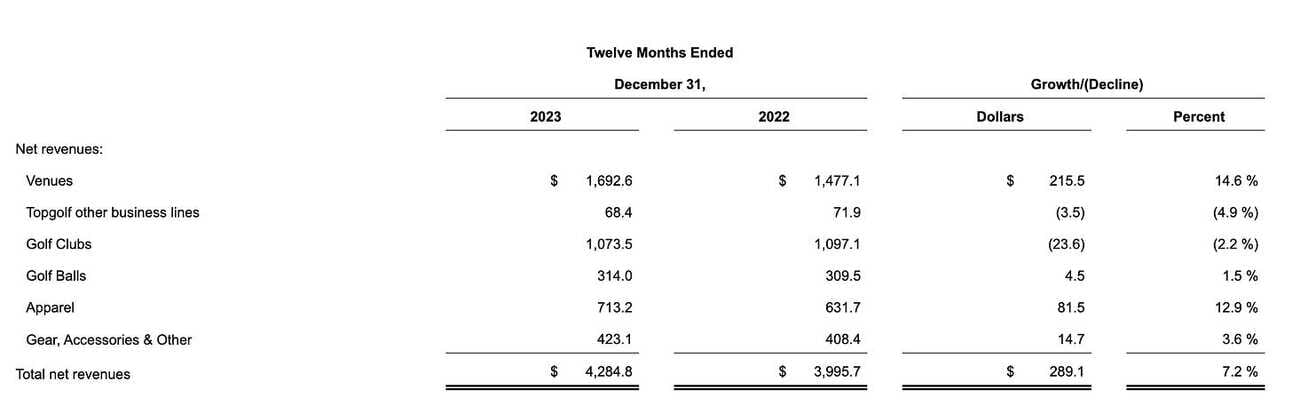

Callaway revenue for 2023 was $4.284 billion — up 7.2% versus 2022.

Here is how the segment revenue breaks out for Callaway.

Topgolf — $1.76 billion (up 13.7%)

Golf equipment — $1.38 billion (down 1.4%)

Active lifestyle — $1.14 billion (up 9.2%)

Topgolf represented 41% of total revenue in 2023. While the topline growth looks good — it is important to remember that they added 12 new venues to achieve that growth. Same venue sales provide a better look at the health of the business. And Topgolf was up 1% in same-venue sales.

Topgolf grew same-venue sales for seven consecutive quarters until the third quarter of 2023.

Quarter 3 — down 3%

Quarter 4 — down 3%

Callaway forecasts Topgolf's same-venue sales to be down mid to high single digits in the first quarter of 2024.

What is the reason for the decline in same-venue sales at Topgolf? Callaway mostly attributes it to corporate events. Corporate events make up roughly 20% of Topgolf’s annual revenue. And in the third quarter alone — corporate events were down 17%.

And Topgolf is forecasting that same venue sales will be flat in 2024. I’ll dig into Topgolf more later.

A quick look at golf equipment and active lifestyle.

Golf clubs finished the year at $1.073 billion — down 2.2%. Golf balls checked in at $314 million, up 1.5%. Golf rounds finished 2023 up 4% — so it is a little interesting that golf ball revenue didn’t see more of a bump. Callaway attributes this to retail channel catch-up in 2022.

I will be curious to see how these numbers stack up against Acushnet when they report in the coming weeks.

Apparel was the massive winner for Callaway in 2023. They recognized $713 million in revenue — up 12.9%.

If we remove the addition of new Topgolf venues in 2023 and just look at the same venue sales growth — it was a relatively mediocre performance for Callaway in 2023.

Golf balls — up 1.5%

Golf clubs — down 2.2%

Topgolf same venues — up 1%

The impact apparel had on Callaway’s business was enormous — it carried their growth.

Getting back to Topgolf.

Callaway has an incredibly unique opportunity with Topgolf. They could essentially become the largest direct-to-consumer brand in golf.

Let me explain.

An interesting piece of information caught my eye in their earnings presentation.

Directors of Instruction in venues are on Callaway staff and are now set up to exclusively sell Callaway equipment to students.

Callaway will begin hosting organized club-fitting events at all Topgolf venues this spring. And TravisMathew will be in 33 Topgolf venues.

So why is this important? Topgolf expects to see 30 million unique visitors in 2024.

There are three primary distribution channels for golf equipment and apparel.

Retail

Golf courses

Direct to consumer (online and brick and mortar)

Callaway has created a fourth distribution channel they have exclusive access to — they own it. And that is Topgolf.

It remains to be seen how this channel will convert to paying equipment and apparel customers. But it is interesting to note that Topgolf has more unique golfers worldwide at its venues than the United States has on-course golfers (26.6 million).

Topgolf is a significant distribution channel no other company can utilize — it is a distribution moat.

Topgolf has the largest audience in golf. The major question is, can Callaway leverage that audience to sell through equipment and apparel at a material rate?

As of this newsletter — Topgolf has 94 owned and operated venues. Those venues are revenue-generating businesses that could double as defacto brick-and-mortar locations.

It will be fascinating to see how the intracompany synergies and strategy play out for Callaway moving forward.

Have yourself a great Monday. Talk to you next week!

Your feedback helps improve Perfect Putt. How did you like this week's newsletter?

If you enjoyed this week’s newsletter, please share it with your friends!

Are you interested in partnering with Perfect Putt? Click the button to learn more about sponsorship opportunities.

Reply